According to the Department for Levelling Up, one in five private renters in the UK spend a third of their income on rent. A quarter find it ‘fairly or very difficult’ to afford their rental payments.

Those are national statistics. Here in Liverpool, the situation is arguably worse. A shortage of housing in the area, combined with increasing inflation, has led market rents to increase by almost 20 percent.

That doesn’t mean existing tenants have had their rents increased by this much. It means anyone looking to rent a new property will likely see a 20 percent increase in what they have to pay.

If you choose to move now, you will have to deal with current market conditions as they are. But what if you don’t want to move? What if you have to move, as a result of circumstances outside of your control?

If you are working, you will have to pay more for less. That means downsizing, sharing with others, or moving to a different area.

But what if you’re on a fixed income?

In 2019, when the two-bed housing benefit rate was £104.15 per week (£450pcm), there were 690 two-bed homes advertised on Rightmove at this exact rental amount. That wasn’t enough homes to go around but it meant that two families could be rehoused every day.

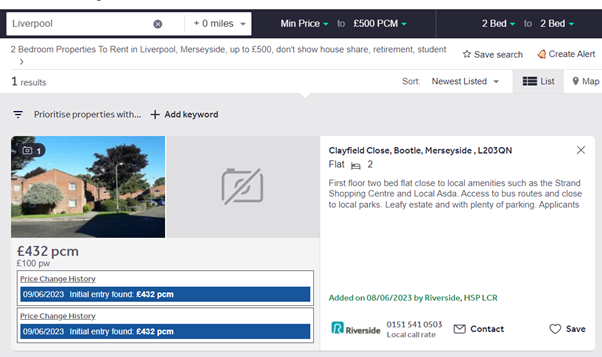

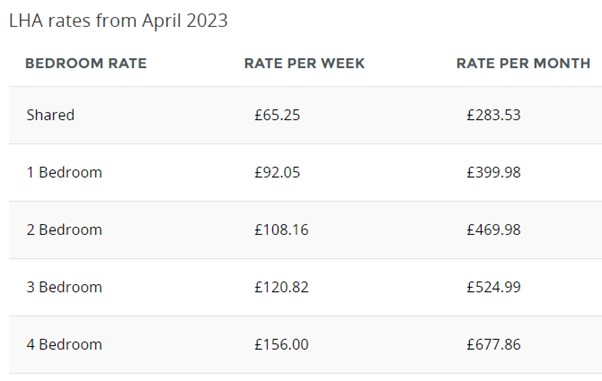

Today, the two-bed rate in Liverpool is £108.16 per week (£469pcm). There is just one two-bed property available under £500pcm and that’s a housing association property.

Image source: Rightmove

Image source: Liverpool City Council

Why is this a problem?

If you’re in receipt of benefits, the housing benefit that you are entitled to is fixed. For those with no experience of local authority housing rates, you may be forgiven for thinking that all your rent is paid, at whatever rent the landlord sets. That’s not the case.

If the market rent is £496pcm, you will get £496pcm.

If the market rent is £525pcm, you will get £496pcm.

If the market rent is £600pcm, you will get £496pcm.

Can’t people top their rent up with other income?

If you start receiving money from employment, your benefits are reduced, so you don’t automatically end up with extra money you can use to top up your rent.

If you’re receiving other types of benefits, there is a reason for that! Maybe you have other liabilities that need to be paid for – like care costs for example – so you can’t use that money for rent either.

The money you use to top up your rent has to come out of your budget for something else, like food or heating. With food inflation running high and energy costs at an all-time high, there is no room to pay Peter and beg from Paul. That’s before you even factor in the higher energy costs for tenants!

The problem ISN’T greedy landlords charging high rents

We’re not saying there are no greedy landlords. Our point is, they’re not the norm and they’re not the cause of this problem. We work with lots of landlords who are trying to do the right thing by their tenants, in the face of rising costs.

With inflation running high, the Bank of England is ramping up interest rates. That means mortgage costs are increasing. Even the most kindhearted landlord can’t sustain a situation where they’re losing money every month because the rent doesn’t cover the mortgage. And why should they? One private individual shouldn’t have to pay another private individual’s housing costs, just because they’re in a landlord/tenant relationship.

Even with a 20 percent increase in rents, many landlords still can’t cover the mortgage. Naturally, they’re making the decision to sell their properties. Their exit from the market adds to the housing shortage.

It’s also worth noting, the reason tenants on housing benefits are renting from private landlords is that there isn’t enough social housing provided by the state. If private landlords didn’t buy properties to rent out – particularly in areas such as Anfield, Everton, and Bootle here in Liverpool – those houses would be empty and falling into disrepair.

What’s the solution?

There is a constant 3-way battle between tenants, landlords, and local authorities. But ultimately they all want secure long-term housing and affordable costs.

• The tenant wants a safe, secure home that works for them

• The landlord wants a good long-term investment that serves them and their family

• The local authority wants to reduce emergency housing burdens and avoid the high costs of supporting/rehousing evicted tenants

These wants and needs aren’t at odds. The following solutions could work for all parties.

Increase the housing supply

Certainly here in Liverpool, we have enough houses – we just don’t have enough homes. There are too many properties in disrepair. Those properties need a private landlord’s investment, so the landlords need to be allowed to buy them.

Liverpool City Council has already sold homes for £1 to first-time buyers. Why not also sell old housing stock to private landlords at knock-down prices? Let those landlords invest their own money in doing them up, on the understanding that they’ll let at affordable rates, to people in receipt of benefits.

This will improve areas, increase the supply of affordable homes, and – crucially – be a net-positive financial exercise for local authorities. It’s a viable alternative to the costs of security, demolition, and the building of new housing schemes.

Increase the housing benefit rates

Obviously, increasing housing benefit rates will cost tens of millions of pounds. But it’s far cheaper than telling tenants facing eviction to stay in their homes until the courts evict them.

That approach causes a squeeze on emergency accommodation, which is very expensive. It also creates serious health and wellbeing issues for evictees. Can you imagine taking your family to a B&B, as a bailiff changes the locks on your home and gives you seven days to collect your belongings when you now have nowhere to put them? These situations are dire for the individuals concerned. They’re also costly for health and social services.

Communities and local government are paying too high a price, as a result of the housing crisis. Increasing benefit rates is actually an affordable solution.

Action plan for local authorities

This whole situation is avoidable. And these suggestions can be combined to create a logical, actionable road map for local authorities.

Authorities might not want to think about increasing housing benefit but doing so will lead to a cost saving. Short-term emergency spending will always cost more than a long-term investment in – and commitment to – community projects.

Here is what we consider to be a practical action plan, that local authorities can use to tackle the affordable housing crisis.

- Sell off houses in disrepair to private investors, thereby saving on housebuilding costs

- Increase housing benefit, saving money on emergency re-housing

- Encourage private landlords to accept tenants in receipt of benefits, offering them direct housing benefit payments to make this an attractive option

We put it to our local authorities, Liverpool City Council and Liverpool City Region Combined Authority, that this approach represents a positive, workable way out of a desperate situation.

The directors of Homesure Property would welcome the opportunity to discuss our ideas in further detail, with local authorities and anyone interested in working with us to make sustainable housing a reality in Liverpool City Region.

To discuss this topic with us, email lettings@homesureproperty.co.uk, FAO Nick Stott and Mark Loughnane, with the subject line ‘Affordable Housing Crisis’.

(Featured image: Graham Robson geograph.org.uk/p/4898483)